How Does Leasing a Car Work?

The car market has transformed dramatically, and for drivers who value efficiency and access to the latest vehicles, understanding how to lease a car has never been more important. If you’ve been wondering whether leasing a car makes sense for your lifestyle, the answer in 2025 might surprise you.

What Is a Car Lease?

A car lease is essentially a long-term rental agreement that allows you to drive a new vehicle for a predetermined period—typically 24 to 48 months—without the commitment of ownership. When you lease a car, you’re paying for the vehicle’s depreciation during your use, plus interest (known as the “money factor”), rather than the full purchase price.

Think of it as accessing premium transportation on your terms. You make an initial payment, followed by fixed monthly installments, and at the end of your lease term, you simply return the vehicle—or choose to purchase it if you’ve fallen in love with it.

How Does Leasing a Car Work? The Mechanics Explained

When you lease a vehicle, several key factors determine your monthly payment:

MSRP (Manufacturer’s Suggested Retail Price): The baseline price set by the manufacturer.

Capitalized Cost (Cap Cost): The actual negotiated price you’re paying—and yes, this is negotiable, just like purchasing.

Cap Cost Reduction: Any down payment, trade-in value, or rebates that lower your capitalized cost upfront, reducing your monthly payments.

Residual Value: The predetermined price the manufacturer will accept to buy back the vehicle at lease end, also known as your buyout price if you choose to purchase.

Money Factor: The interest rate on your lease, typically displayed as a decimal (multiply by 2,400 to convert to an APR percentage).

Acquisition Fee: An upfront administrative charge, typically $395-$995, that covers the leasing company’s processing costs.

Security Deposit: A refundable deposit (often equivalent to one monthly payment, rounded up) that some lessors require, though many leases no longer mandate this.

Your monthly payment essentially covers the difference between the capitalized cost and the residual value, divided across your lease term, plus the cost of borrowing.

Understanding Lease Terms and Structure

Lease Term: The duration of your agreement, typically ranging from 24 to 48 months. Shorter terms mean higher monthly payments but more frequent access to newer vehicles, while longer terms reduce monthly costs.

Mileage Cap: Most leases include annual mileage limits between 10,000 and 15,000 miles. Exceed these limits, and you’ll face per-mile charges ranging from 15 to 30 cents—costs that accumulate quickly. Before you lease a car, calculate your typical driving patterns honestly.

Open-End Lease: While most consumers sign closed-end leases (where you can walk away at lease end), open-end leases—typically used for commercial purposes—require the lessee to pay the difference if the vehicle’s market value is less than the residual value at return. Most personal leases are closed-end, protecting you from market value fluctuations.

Disposition Fee: A charge of $300-$500 assessed when you return the vehicle at lease end (waived if you purchase the vehicle or lease another from the same brand).

The 2025 Leasing Landscape: Why Now May Be the Right Time

The leasing market has evolved considerably. After falling to just 17-18% of new car transactions during recent market disruptions, manufacturers are now offering compelling lease incentives to attract qualified buyers back. For consumers with excellent credit, this translates to opportunity.

In today’s high-interest-rate environment, leasing often presents better terms than traditional financing, allowing you to access better-equipped vehicles with lower monthly payments. Many manufacturers are rolling out competitive lease programs specifically designed to make premium vehicles more accessible.

Is Car Leasing a Good Idea for You?

Whether a car lease aligns with your lifestyle depends on several factors:

Leasing makes sense if you:

- Drive fewer than 12,000-15,000 miles annually

- Appreciate driving the latest models with current technology and safety features

- Are considering a luxury vehicle that depreciates quickly and is expensive to maintain

- Prefer predictable costs with warranty coverage throughout your lease term

- Value your time and want to avoid the complexity of eventual resale

- Use a vehicle for business purposes (potential tax advantages apply)

Consider purchasing if you:

- Drive extensively and want unlimited mileage

- Plan to keep your vehicle for more than 5 years

- Are considering a reliable brand like Toyota with long-lasting quality and low maintenance costs

- Prefer to build equity and eventually eliminate car payments

- Want the freedom to customize or modify your vehicle

Leasing vs. Buying: It Depends on the Vehicle

There’s no universal answer to whether you should lease or buy—the right choice often depends on which vehicle you’re considering. At Cartelligent, we encourage clients to think about the warranty period and whether they’d consider an extended warranty when making this decision.

Consider leasing luxury vehicles. Premium brands like BMW, Mercedes-Benz, Audi, and similar marques depreciate rapidly and come with higher maintenance costs once the warranty expires. Leasing allows you to enjoy these vehicles during their warranty period, then return them before major maintenance expenses arise. You’ll always drive under warranty protection while avoiding the steep depreciation hit.

Consider buying reliable brands. Vehicles like Toyota, Lexus, and Honda are known for exceptional longevity and low maintenance costs. These cars often run strong well past 100,000 miles with minimal issues. If you’re considering one of these dependable models, buying may offer better long-term value since you can drive them for years beyond a typical lease term without significant repair expenses.

The key is matching your financing decision to the specific vehicle’s characteristics—not following a one-size-fits-all rule. Our advisors can help you evaluate whether leasing or buying makes more sense for the particular model you’re considering.

Lease Costs Beyond the Monthly Payment

Understanding the full cost structure helps you make an informed decision:

Upfront Costs (Drive-Off Fees):

- First month’s payment

- Acquisition fee

- Security deposit (if required)

- Cap cost reduction (down payment, if applicable)

- Registration and title fees

- Sales tax on cap cost reduction and monthly payments (varies by state)

Ongoing Costs:

- Monthly lease payment

- Insurance (comprehensive and collision coverage required)

- Maintenance and routine service

- Excess mileage charges (if you exceed your mileage cap)

End-of-Lease Costs:

- Disposition fee (unless purchasing or re-leasing)

- Excess wear-and-tear charges

- Any remaining payments if terminating early

You’re responsible for maintaining the vehicle according to manufacturer specifications and returning it in good condition (normal wear and tear is expected and acceptable). The vehicle will be covered by the manufacturer’s warranty throughout your lease term, providing peace of mind against unexpected repair costs.

How to Lease a Car: The Strategic Approach

- Research and Compare: Start by researching vehicles that interest you and current lease offers in your market. Don’t rely solely on advertised deals—they typically exclude taxes and fees. This is where Cartelligent excels—our advisors conduct comprehensive research, curating the best vehicle options that match your lifestyle and budget, saving you countless hours of online searching and dealership visits.

- Check Your Credit: The most competitive lease terms are reserved for those with excellent credit scores (typically 700+). Review your credit profile before shopping.

- Negotiate Everything: The capitalized cost, money factor, acquisition fee, and even the mileage cap are often negotiable. Approach leasing with the same due diligence you’d apply to a purchase. Cartelligent handles all dealer negotiations on your behalf, leveraging our industry expertise and relationships to secure terms you won’t find on your own. We know exactly which numbers should move and how to negotiate with dealers to get the best offer for you.

- Consider Your Cap Cost Reduction: While a larger down payment reduces monthly costs, remember you won’t recover this money if the vehicle is totaled or stolen early in the lease term. Many experts recommend minimizing upfront cash. Our advisors will walk you through this decision, explaining the trade-offs specific to your situation.

- Calculate Your Buyout Price: If you think you might want to purchase the vehicle at lease end, understand your buyout price (residual value plus any applicable fees) from the start.

- Navigate the Paperwork: Lease agreements contain complex terminology and fine print regarding your mileage allowance, wear-and-tear guidelines, disposition fee, early termination penalties, and end-of-lease options. Cartelligent guides you through every document, ensuring you understand exactly what you’re signing before committing.

- Arrange Delivery: Once everything is finalized, your vehicle will be delivered to one of our convenient delivery centers or brought directly to you. We’ll walk you through the final paperwork and show you how everything works—the entire delivery process takes less than an hour for most clients.

End-of-Lease Options: What Happens Next?

When your lease term concludes, you typically have three options:

Return and Walk Away: Simply return the vehicle after a final inspection, pay the disposition fee and any applicable charges for excess mileage or wear, and walk away.

Lease a New Vehicle: Transition seamlessly into a new lease with updated features and technology. The disposition fee is typically waived when leasing another vehicle from the same brand.

Purchase Your Leased Vehicle: If you’ve grown attached to your car, you can buy it at the predetermined buyout price (residual value). This option makes particular sense if market conditions mean the vehicle is worth more than the buyout price, or if you’ve exceeded your mileage cap significantly.

The Cartelligent Advantage: Leasing Without the Hassle

Navigating lease negotiations, comparing multiple offers, understanding cap cost reductions, acquisition fees, and money factors—all of this requires expertise and time. This is where having an insider on your side transforms the experience.

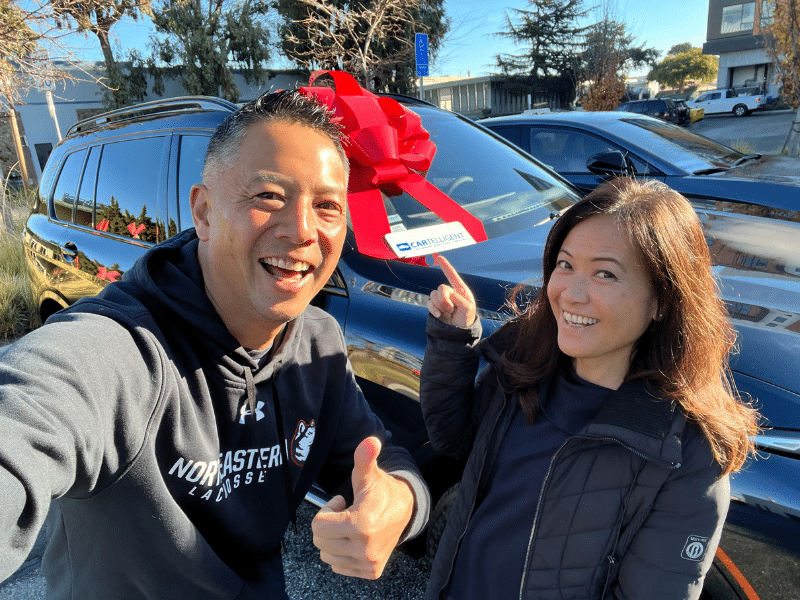

At Cartelligent, we’ve helped clients throughout California sidestep the hassle and outsmart the system for 25 years. Our advisors understand exactly how to secure competitive lease terms, identify the best manufacturer incentives, negotiate lower acquisition fees, and ensure you’re making an informed decision that aligns with your lifestyle and budget.

Whether you’re certain about leasing or exploring your options, we provide unbiased guidance and handle every detail—from locating your ideal vehicle to negotiating favorable terms to delivering it where you want it.

Making Your Decision

Leasing a car offers compelling advantages for the right driver: lower monthly payments, access to newer vehicles, warranty peace of mind, and the flexibility to upgrade every few years. The key is understanding how a car lease works—from acquisition fees to disposition fees, from cap cost reduction to buyout prices—honestly assessing your driving patterns and preferences, and negotiating from a position of knowledge.

The question isn’t just “Is car leasing a good idea?” — it’s whether leasing aligns with how you want to experience automotive transportation. For many drivers who value their time, appreciate current technology, and prefer predictable costs, the answer is increasingly yes.

Ready to explore your options? Get an insider on your side and discover how seamless leasing a car can be. Our expert advisors will provide personalized guidance on whether leasing fits your needs—with zero obligation and 100% satisfaction guaranteed.