Leasing a Car: The Lessons First-Time Clients Learned (That You Don’t Have To)

We hear it all the time at Cartelligent: “I wish I’d known that before I signed.”

When you’re leasing a car for the first time, the dealership makes everything sound straightforward. Low monthly payments, a brand-new vehicle, the latest safety features—what’s not to love? But many first-time lessees learn expensive lessons the hard way, discovering hidden costs and unexpected complications only after they’ve driven off the lot.

The good news? You don’t have to make these mistakes yourself. After helping thousands of clients navigate the leasing process, we’ve compiled the most common “wish I’d known” moments into one essential guide. Consider this your insider’s advantage.

The Mileage Miscalculation

“I figured 10,000 miles a year would be plenty,” Marcus explained when he came to us looking to get out of his lease early. “I didn’t really think about it.”

He should have. The average American drives approximately 13,500 miles annually, yet most lease agreements only include 10,000 or 12,000 miles per year. The overage fees? They range from 15 to 30 cents per mile, and they add up shockingly fast.

Marcus was facing a $2,800 penalty at lease-end, essentially paying for mileage he could have negotiated upfront for a fraction of the cost.

The smarter approach: Before leasing a car, track your actual driving for a month or two. Consider any lifestyle changes on the horizon—a new job, a move, kids starting activities across town. As an auto broker, we can help you negotiate the right mileage allowance from the start, which costs far less than paying overage fees later. And if your driving habits are truly high, we’ll tell you honestly if leasing is the wrong choice for your situation.

The Negotiation That Never Happened

“I thought lease prices were fixed,” Jennifer admitted. “The dealer said this was the manufacturer’s special lease deal, so I assumed I couldn’t negotiate.”

She was wrong. While manufacturer lease programs do set the residual value and interest rate (called the money factor), the capitalized cost—essentially the purchase price of the vehicle—is always negotiable, even with special lease deals.

Jennifer could have negotiated thousands of dollars off the selling price, which would have lowered her monthly payment or reduced her drive-off costs. Instead, she paid full sticker price because she didn’t believe she had any negotiation power. She tried with a previous purchase and got nowhere with the dealer.

The smarter approach: This is where we become invaluable as an auto broker. We negotiate the capitalized cost on every lease, manufacturer special or not. We also scrutinize the fees section of your lease agreement—many dealer charges can be reduced or eliminated entirely. The result? Lower payments, less money due at signing, or both.

The Fine Print They Didn’t Read

“Excessive wear and tear,” the lease inspector said, pointing to several door dings and a small windshield crack on David’s returned lease. The bill: $1,850.

“I thought normal wear and tear was covered,” David said. “I didn’t realize their definition would be so strict.”

If you return your leased vehicle with significant scratches or dents, you’ll be charged the full market price for repairs. Some leasing companies have extremely exacting standards for what constitutes “normal” wear and tear, and they outline them in the contract most people never fully read.

The smarter approach: Before leasing a car, understand your lessor\’s specific wear-and-tear policy. Document the vehicle\’s condition with photos when you take delivery. And if you notice damage as your lease nears its end, get repair estimates from independent shops—it\’s almost always cheaper than what the leasing company will charge. Better yet, work with your Cartelligent advisor who knows which brands have the most reasonable inspection standards and can steer you toward better terms. And, you can protect yourself against lease end penalties. You can get a product for a fraction of the cost of the dealer.

The Down Payment That Vanished

“Excessive wear and tear,” the lease inspector said, pointing to several door dings and a small windshield crack on David’s returned lease. The bill: $1,850.

“I thought normal wear and tear was covered,” David said. “I didn’t realize their definition would be so strict.”

If you return your leased vehicle with significant scratches or dents, you’ll be charged the full market price for repairs. Some leasing companies have extremely exacting standards for what constitutes “normal” wear and tear, and they outline them in the contract most people never fully read.

The smarter approach: While this situation has a low probability of occurring, we can negotiate terms that minimize or eliminate the need for a substantial down payment (if this is a concern for you) while still keeping your monthly costs manageable. Of course, every situation is different-your advisor will guide you to make the decision that’s best for you.

The Hidden Costs Nobody Mentioned

Tom’s advertised lease payment was $299 per month. His actual out-of-pocket? Far more than he expected.

He discovered acquisition fees (typically $595 to $1,095), higher insurance requirements, sales tax on each payment, and a disposition fee when he turned the car in. None of this was prominently disclosed in the attractive advertisement.

The smarter approach: When evaluating a lease, calculate the total cost over the entire term. Take your monthly payment, multiply it by the number of months minus one (the first payment is usually included in drive-off costs), then add your amount due at signing and any end-of-lease fees. This is your real cost, and it’s often quite different from what the monthly payment alone suggests.

We’ll do this calculation for you across lease options, presenting an apples-to-apples comparison so you can make an informed decision.

The Early Exit That Cost a Fortune

“My job relocated me,” Emma explained. “I needed to return my lease two years early.”

Early termination fees on leases can run into the thousands of dollars. Unlike purchasing a vehicle, where you can sell at any time without penalty, ending a lease early comes with significant financial consequences. There are ways to minimize the damage—lease transfers, buyouts, or negotiated settlements—but none of them are attractive options.

The smarter approach: Only lease a car if you’re confident about the period you want to lease for. If there’s any uncertainty about major life changes, consider a shorter lease term or buying instead. Your advisor can help you think through your timeline realistically and choose the right option for your situation.

What Smart Leasing Actually Looks Like

Here’s what our most successful leasing clients do differently:

They know their numbers before they start shopping. They’ve calculated their budget, tracked their driving habits, and understand what they can realistically afford—not just the monthly payment, but the total cost.

They maintain the vehicle well. They follow the manufacturer’s service schedule, address small issues before they become big ones, and document everything. When it’s time to return the vehicle, they’re prepared.

Maybe you’re wondering, should I lease or buy a car? Understanding the true costs is smart, although your advisor will guide you to make the decision that’s best for you.

Most importantly, they work with an expert who has their interests at heart. A dealership salesperson is trying to maximize profit on the transaction. The advisors at Cartelligent are working to get you the best possible deal. That fundamental difference in incentives changes everything.

Your Advantage with Cartelligent

When you work with Cartelligent for your lease, you’re not just avoiding these common pitfalls—you’re gaining an advocate with deep industry knowledge and negotiating power.

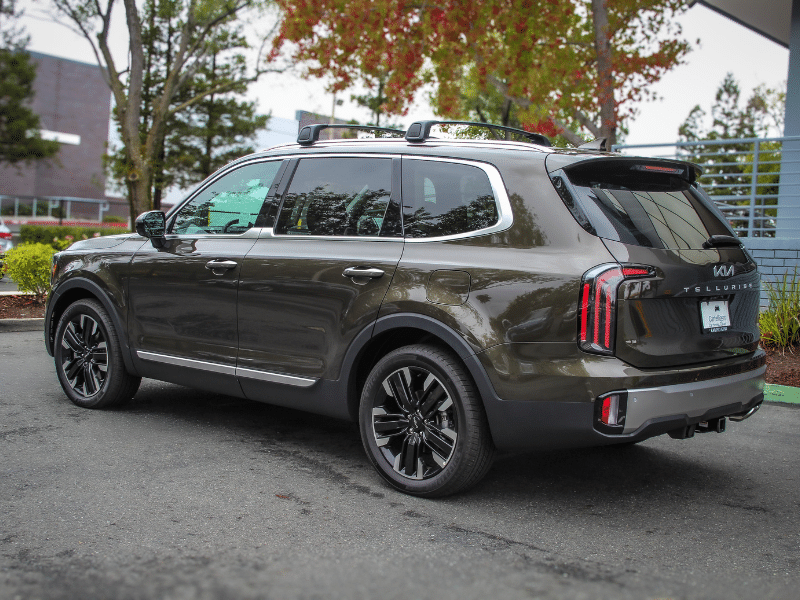

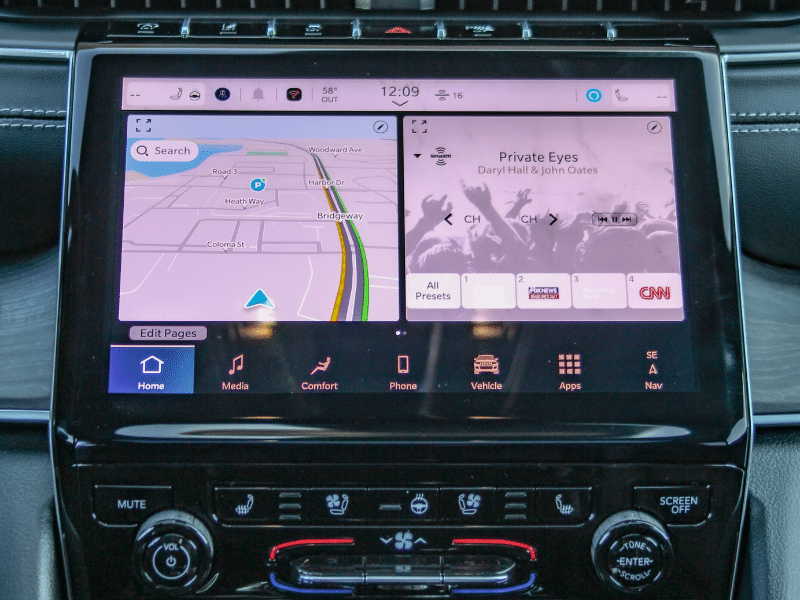

We handle the entire process: researching which vehicles lease well (some retain value far better than others, making them significantly cheaper to lease), negotiating the best possible terms, reviewing every line of your contract, and ensuring you understand exactly what you’re agreeing to before you sign anything.

We’ve seen every dealership trick, every hidden fee, and every contract clause designed to benefit the lessor at your expense. More importantly, we know how to counter them.

Our clients don’t learn these lessons the hard way. They learn them from us before they make a costly mistake.

Because when it comes to leasing a car, the best education is learning from someone else’s experience—not your own bank account.

Ready to start your new car search? Let’s talk about your next vehicle on your terms, not the dealership’s.