Preparing for Your Lease Return: A Comprehensive Guide

Approaching the end of your car lease in California? You have clear choices: considering a lease buyout to purchase your current vehicle, leasing a car again (from the same brand or trying something new), or simply returning your car.

But what about those crucial details like potential charges, unexpected mileage fees, or ensuring a seamless transition? This comprehensive guide cuts through the confusion, outlining key considerations for your lease return. Whether you’re turning in a leased car under mileage or navigating a mileage overage situation, we’ll explore:

- What charges may be due at lease end?

- Is buying your leased vehicle a good option?

- What happens if you go over mileage on a lease?

- What do you want to drive next?

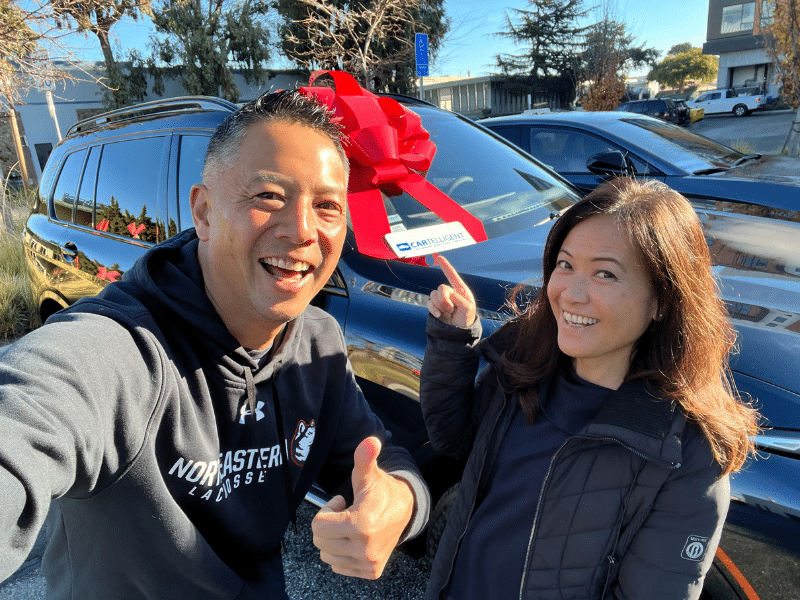

This guide provides essential information, but for personalized advice and the best strategy for your unique situation, connect with a Cartelligent Advisor – your best resource to ensure a smooth and cost-effective transition. Click here to get started.

Navigating Lease-End Charges: What to Expect

Potential lease-end charges can include mileage overage, excess wear, late return fees, and disposition fees. Understanding these helps you plan.

Your lease contract specifies a pre-set mileage allowance per year. For instance, a three-year lease with a 12,000-mile annual allowance should typically be returned with less than 36,000 miles to avoid overage charges.

To estimate your mileage at lease end, divide your current mileage by the number of months you’ve had the vehicle, then multiply that by the total number of months in your lease. This assumes a consistent driving pattern.

- Under-mileage: If your estimated mileage falls under your allowance, you can simply return the vehicle at lease end. While there’s no credit for being under mileage in the lease contract, any additional mileage you purchased but didn’t use is often refundable.

- Over-mileage: If your estimated mileage will exceed your allowance, you have three primary options: reduce your driving, pay the mileage penalty at lease end (typically $0.15-$0.30 per mile, depending on the brand), or consider a lease buyout of the vehicle.

Excess Wear

Leased vehicles must be returned in good condition to avoid excess wear charges. It’s often worthwhile to consider scheduling an end-of-lease inspection through the manufacturer. In most cases, you can set up an appointment for an inspector to come to your home or office to look at the car and give you an estimate of your expected wear charges.

Additionally, if the tires have less than 1/8-inch tread depth (a common industry standard), they should be replaced to avoid potentially costly tire replacement charges from the dealership. Always check your specific lease contract for exact conditions.

If you purchased SafeLease when you leased your vehicle, it protects you against up to $5,000 of wear and tear damage, including worn tires, dings, dents, scratches, wheel damage, windshield chips, and interior stains and tears. With SafeLease, there’s no need to hassle with getting these repaired yourself.

Late Return Fees

Every leased car must be returned by the lease termination date specified in your contract. You can return the vehicle to any dealer of the same brand. If you’re working with Cartelligent for your new vehicle, we can assist with the return of your current leased car, simplifying the process. Some banks may offer a small grace period of a few days, but beyond that, fees will begin to accrue.

Disposition fee

A disposition fee is typically due when the leased vehicle is returned; the exact amount will be specified in your contract. Many brands will waive this charge if you lease another vehicle with them.

Should You Buy Out Your Leased Car? Weighing the Pros and Cons

If you love your current vehicle, a lease buyout can be an attractive option to consider. However, many clients choose to lease the latest version of their current model instead, benefiting from updated technology and safety innovations.

If your current vehicle needs significant work or is over mileage, it can be tempting to buy out the lease to avoid penalties. The purchase amount is prearranged at lease signing and assumes the vehicle will be in top condition and within the allowed mileage. This often means the buyout cost may exceed the vehicle’s current market value. Your Cartelligent Advisor can help you decide if it makes more sense for you to pay any penalties or complete the lease buyout. Our car buying service ensures you make the most informed decision.

Your Next Ride: Exploring New Lease Options or Buying

With the lease return process understood, your next decision is about your next vehicle.

Leasing a new car allows you to enjoy the benefits of driving a newer vehicle while often maintaining a low monthly payment. Cartelligent makes it easy to lease another vehicle from the same brand or to explore something entirely new.

If you’re new to leasing, see our “Beginners Guide to Leasing”.

Lease (or buy) another vehicle from the same brand

Many manufacturers offer incentives to returning lessees who choose another vehicle from their brand. In addition to financial incentives like loyalty rebates, some may waive the last few lease payments to help clients transition into a newer model before their current lease ends.

Lease (or buy) a vehicle from a different brand

Part of the appeal of auto leasing is the flexibility to drive a different car every few years. Some manufacturers even offer rebates to current lessees of competing brands, making it easier to try a new brand.

Special order exactly what you want

Regardless of whether you stay with your current brand, considering a special order for your new vehicle can be a smart strategy. Ordering allows you to get exactly the features you want—and avoid paying for features you don’t. We particularly recommend ordering European vehicles, which can be configured in thousands of ways. Talking to your Cartelligent Advisor three to four months in advance will give you ample time to determine if ordering is the best approach for your new car search.

Return the car and walk away

Of course, you are under no obligation to lease or buy a car unless you wish to. If you no longer need the car, you can simply return it and conclude your lease.

Simplify Your Lease Return and Next Car Search with Cartelligent

Whether you’re turning in a leased car under mileage or navigating typical lease-end procedures, Cartelligent’s auto leasing service makes the process efficient and helps you secure a great price on your next vehicle.

Ready for a seamless lease return or to explore your next dream car? Let Cartelligent simplify the process. Get started online today to ensure a smooth transition and find the best car deals.