Navigating Lease End Anxiety: Your Guide to a Smooth Return

Leasing a car offers the flexibility of driving a new vehicle every few years. But as your lease term approaches its end, does the thought of hidden fees for every scratch or ding cause anxiety? You’re not alone. The unpredictable costs of excess wear and tear can transform a simple return into a financial headache.

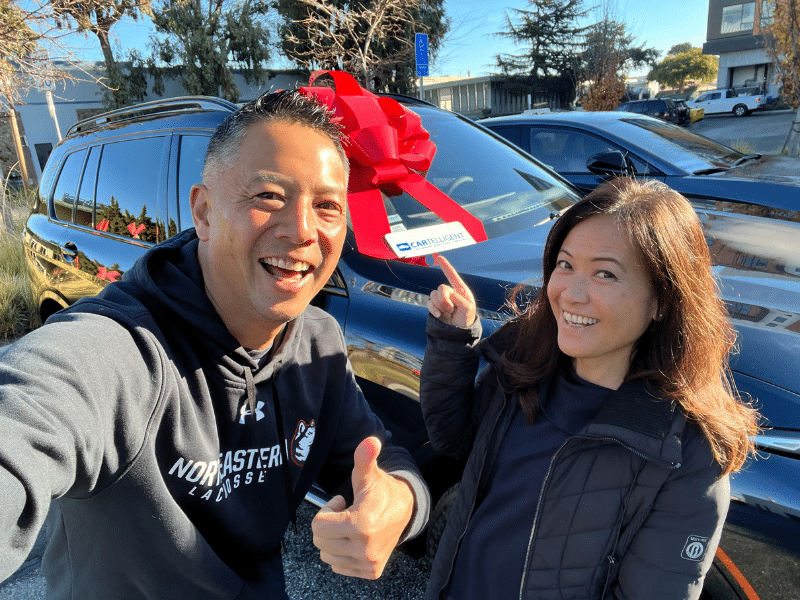

At Cartelligent, we empower you with the knowledge you need. As an auto leasing services for over 25 years, we’ve seen a thing or two. This guide will reveal how lease protection plans offer invaluable peace of mind and financial security, helping you navigate your lease end with confidence.

Decoding Lease-End Charges: What Counts as “Excess Wear”?

To truly understand the value of lease protection plans, it’s crucial to know what is “excess” wear and tear. While normal usage is expected, any usage beyond that can trigger additional charges. Your lease agreement outlines the specifics, here are typical examples that often lead to fees:

- Exterior Scratches and Dents: Minor blemishes from daily driving may be acceptable. However, any scratch through the paint where you can see bare metal typically incurs charges. Similarly, dents exceeding the size of a quarter are usually considered excess wear.

- Tire Wear: Lease agreements specify a minimum tread depth for tires. If your tires fall below this threshold at the end of the lease, you’ll likely face replacement costs.

- Interior Damage: Stains on upholstery or carpets, tears in seats, and burns (even small ones) are common culprits for lease-end fees. Excessive wear on floor mats can also result in charges.

- Windshield Damage: Cracks or chips in the windshield can compromise structural integrity or obstruct the driver’s line of sight. You can expect charges for cracks or chips.

These examples illustrate how typical usage can lead to unexpected fees. Individually, these charges might seem minor, but collectively, the cost of addressing such wear and tear can add up quickly and unexpectedly. For instance, a small dent can cost between $200 and $500 to repair. Interior stain removal can range from $100 to $300 per incident, and replacing tires can easily cost hundreds of dollars per tire. Windshield repairs or replacements can also be a significant expense.

Reading your lease agreement thoroughly is a good first step in understanding the specific wear and tear standards applied during the lease-end inspection. Familiarizing yourself with these guidelines empowers you to understand potential charges and protect yourself.

Your Shield Against Surprise Fees: The Benefit of Lease Protection

We strongly recommend lease protection plans as part of your next new lease. This valuable add-on serves as a financial safety net, mitigating unexpected costs associated with normal, yet chargeable, wear and tear.

Investing in lease protection offers multiple advantages, providing both financial security and peace of mind:

- Financial Security: The most significant benefit is eliminating or significantly reducing the risk of unexpected lease-end charges. With protection in place, you can breathe easier, knowing minor scratches, dents, or interior blemishes within coverage limits won’t result in hefty bills. Consider returning your vehicle with minor dents and interior stains. Without protection, these could easily amount to $500-$1000 in charges. Lease protection plans can absorb these costs, saving you money.

- Stress Reduction: The anxiety associated with the lease-end inspection can be considerable. Knowing you have lease protection in place significantly reduces this stress. You can enjoy your vehicle throughout the lease term without worrying about every minor imperfection. This peace of mind allows you to focus on the excitement of your next vehicle, not dwelling on potential penalties.

- Straightforward Claims Process: Navigating a claim is straightforward. If after you return your leased vehicle you receive a final bill for excess wear and tear, your Cartelligent Advisor will guide you through the claim process. Your lease protection provider then handles the financial details directly with the leasing company. This means less paperwork for you, fewer phone calls, and more time focusing on your next new vehicle.

Choosing the Right Lease Protection Plan

When considering lease protection plans, understanding the specifics of the plan is crucial. Pay close attention to coverage limits, which specify the maximum amount the protection will cover. Also, be aware of any exclusions—certain damage or modifications might not be covered. For example, damage from accidents, misuse, or neglect is typically excluded. Understanding these limitations gives you a clear picture of what is and isn’t protected.

Who Benefits Most?

Lease protection plans can benefit many individuals. Families with young children or pet owners, who may face a higher risk of interior damage, often find this protection invaluable. Individuals who frequently drive in urban environments where minor scrapes and dings are more common might also find it a worthwhile investment. The ability to enjoy a vehicle with confidence and peace of mind is a key reason our clients appreciate having lease protection in place.

Lease End without Protection? Cartelligent Can Still Help

If you’re nearing the end of your current car lease and don’t have a lease protection plan, Cartelligent can still help. We provide expert guidance to understand potential charges and explore your options. In some cases, we may be able to recommend a strategy to help you lower any out-of-pocket expenses. We may also be able to assist you with a lease buyout, helping you determine if purchasing your current leased vehicle is the better financial move for you.

Your Next Steps

Don’t let the fear of unexpected fees overshadow the excitement of your next new car search. The end of your lease should be a smooth and positive transition.Contact Cartelligent today for personalized guidance. Simply fill out the form at the bottom of this page, or visit Cartelligent.com to get started.